By Dip Patel, CTO

Well, it depends on which cryptographers you ask. Operating at the cross-section of math, computer science, physics, and engineering, cryptographers may shun blockchain for the bad PR bagged by the likes of Silk Road — or they may admit that most people today wouldn’t be talking about cryptography at all if it weren’t for Bitcoin.

Whatever variety of engineer, mathematician, or scientist you’re discussing, almost all of us have something in common with cryptographers: We’re all puzzle solvers. We love finding hard challenges and cracking their code. No wonder so many of us have gravitated towards blockchain, drawn by the siren song of a currency that’s cryptic at its core — it’s about as easy as luring a goth rocker into a haunted house on Halloween.

Decrypting Massive Change

There are myriad explanations of cryptography’s role in blockchain to be found, like this solid backgrounder. A compact cryptography explanation would be to say that it’s the science of making information secure when adversaries are present, and it enables secure communications even if those adversaries have no limits to their resources. Encryption has an incredible history, but in the current digital world — where it’s very simple to transmit and copy sensitive information — the importance is even more paramount today. Ciphers are a type of algorithm that encrypt data, making that data meaningless unless it’s decrypted — and you need a secret key to do that.

Another function of cryptography is its service: a means to a confidential end. It’s not a complete solution in and of itself, but part of a larger system that’s overall hell-bent on security. Examples of security services cryptography provides include:

- confidentiality

- integrity

- immutability

- authentication

- non-repudiation

- accountability

From there, modern cryptography gets deep — very deep. If mathematical concepts like sets, groups, fields, finite fields, order, prime fields, rings, cyclic groups, abelian groups, and modular arithmetic sound like fun, then congratulations! You may be a cryptographer, on the verge of developing the next and best zero-knowledge proof, or becoming a genius in the field like Silvio Micali, founder of the Algorand blockchain (don’t miss this “Off the Chain” interview for scintillating cryptography intensive).

But if you’re not ready to go there yourself, you can at least appreciate why the field attracts such serious thinkers — why the people who are into it are really into it.

Cryptography is very rational, so the rules are (fairly) simple to understand. Math is easier to comprehend for engineers/scientists than human rules/emotions are, so the application of very hard math with almost no emotion appeals greatly to these kinds of minds. (That’s one of the main reasons I veered away from the engineering field after earning a Masters in Electrical Engineering: I personally find the human puzzle-like sales and leadership — more engaging since there are no rules. It’s basically pure chaos!)

Another reason cryptography attracts such talent is that it’s so important. The very backbone of how e-commerce, and in turn the global economy, works is through encryption. Nothing is more amazing than watching something you built literally change the world.

A Cryptic History

To many, cryptography has almost become synonymous with cryptocurrency, but of course, the practice of encryption far predates the arrival of Bitcoin and Ethereum on Earth. The earliest known examples date back almost 4,000 years, to Egyptian hieroglyphs circa 1900 BC. The famed Caesar cipher dates from ancient Roman times.

Cryptography (and its codebreaking evil twin, cryptanalysis) began progressing through the ages, with modern methods emerging from Arabic nations, then spreading throughout Europe. Talk about world-changing technology, by World War II mechanical/electromechanical cipher machines had everything to do with whether key battles were won or lost — the aptly-named Enigma device was a powerful weapon for Germany until it wasn’t, decrypted by British brains on the level of Alan Turing (a name well-known throughout the blockchain world).

Low-tech, but equally effective cryptography was employed by the US military’s use of Native American code talkers — fluent speakers of uniquely complex languages. In World War I, the Cherokee and Choctaw people helped pioneer it, and then the Navajo speakers made it famous in WWII.

With the rise of personal computing and global networks, everyday people began employing cryptography without even thinking much about it. That password on your Gmail account? That little “s” on the “HTTPS” of Amazon’s checkout page? Cryptography at work — enabling all of us to operate online with at least some semblance of security. (*Note: if you ever come to a website asking you for information that doesn’t have the “s” on the end of “HTTPS”, the site is insecure and you should avoid sharing any information.)

The Security Equation

This brings us to the merger of cryptography and currency, a.k.a. Cryptocurrency — a huge step forward in the quest for digital money that is truly secure.

Bitcoin broke through in the digital money realm by employing blockchain as its bookkeeping system. A decentralized ledger keeping the books, i.e. the transactional database, is distributed across a peer-to-peer network and agreed on by its participants, instead of a central authority. Previously, more centralized attempts at digital money, like DigiCash, B-money, and Hashcash, paved the way for Bitcoin but failed for various reasons.

One of the most interesting connections I see between cryptography and the success of Bitcoin is its role in enabling one of Bitcoin’s most clever features: digital scarcity.

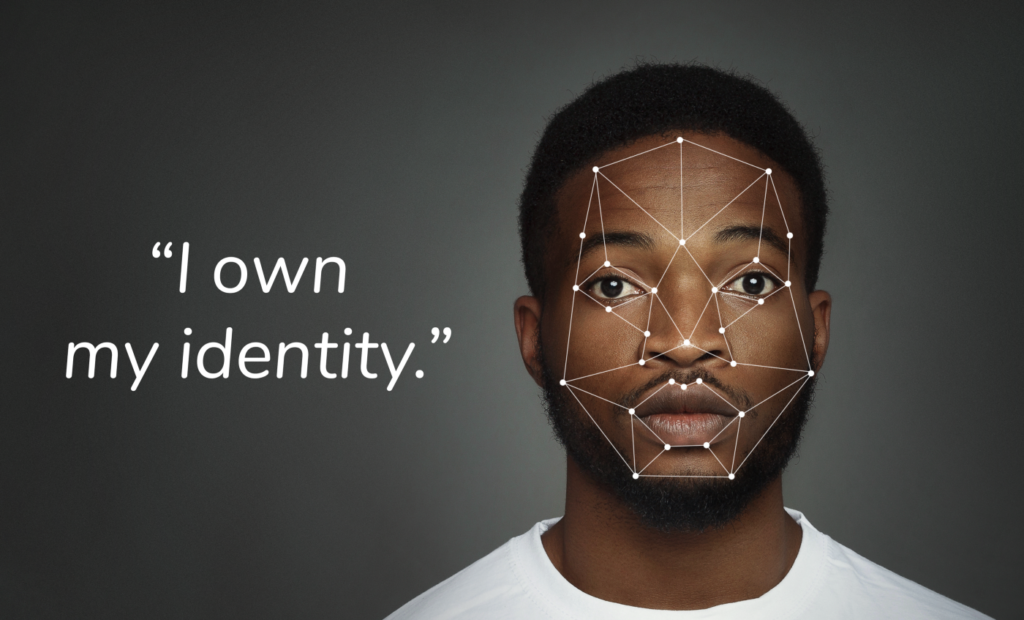

Thanks to the blockchain, Bitcoin can be issued in a way that is limited and timed, with each bitcoin (or its fractional Satoshi) linked immutably to its owner, who can keep full control over it until such time that they transfer it to someone else. This ownership is mathematically verifiable, an attribute that in turn powers scarcity.

The key action in the Bitcoin network, the transfer of value, couldn’t happen without excellent security. Cryptographic hash functions (the act of transforming an input data block into a smaller unpredictable output) make Bitcoin mining go, and Bitcoin uses the Secure Hash Algorithm (SHA) known as SHA-256 (twice actually — double SHA-256). It’s a confidence-inspiring algorithm that’s super-secure because it’s extremely difficult to hack.

And the more secure a system is, the more value it can transact and collect. If you start a bank and can convince people that your bank is more secure than the competition, then more people will trust their money with you.

It’s the same with cryptocurrency. The trust that people have in the cryptographic functions that power Bitcoin — and its subsequent ability to fend off many kinds of attacks — is what gives it its value, and is helping to build up to an entity with billions — and potentially trillions — of dollars in market value. There’s not a cryptocurrency out there that can reliably operate without proving it has an extremely secure network.

Security is value.

Block to the Future

Cryptography isn’t the only thing that makes Bitcoin secure. The mining protocols themselves that allow transactions to be validated and added to the blockchain play a big part in securing the network. Bitcoin’s ultra-competitive lottery mechanism makes it extremely difficult for any one miner to consecutively add new transaction blocks, prevent certain transactions, roll back your own spends, or reverse a past transaction — the computing power required to attempt many of these maneuvers is virtually unattainable.

The Proof of Work (PoW) consensus mechanism that’s central to Bitcoin’s network security is pure — an all-math process that requires the most energy. Other mechanisms for consensus use some form of a proxy to reduce energy (and increase speed) — but that comes at a cost of centralization (giving a single entity more power).

Soluna is helping to mitigate the considerable energy expenditures of PoW, building high-performance, off-the-grid data centers that are co-located with, and powered by 100% renewable energy power plants. We’re turning the high power consumption of these blockchains into a net-positive engine that allows green energy plants to be constructed and become profitable.

While helping Soluna to build this vertically integrated approach, I’ve become hyper-aware of the intense nature of cryptography, and the role it plays in driving and securing Bitcoin. I’ve certainly developed an even higher respect for the talented developers of these encryption algorithms than I did before. Just try carrying out the SHA-256 hashing steps by hand (Really! Try it.), and you’ll see what it takes to encrypt and decrypt data.

Moving forward, I’m highly intrigued to see how blockchain and cryptography will continue to feed into each other. Cryptocurrency has ended cryptography’s four-Millenium run as an undercover operation and pushed it into the great wide open.

Its traditional practitioners might prefer to keep their exhilarating field a secret, but really they should welcome the publicity. Greater awareness can only serve to draw in new minds, bringing a bevy of fresh cryptographic benefits to us all: increased applications for distributed networks, improved power efficiency, and quantum resistance to name just a few. After 4,000 years of covert service, blockchain is just starting to uncover what cryptography can do.