ALBANY, N.Y., August 15, 2022 – Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH), the parent company of Soluna Computing, Inc. (“SCI”), a developer of green data centers for cryptocurrency mining and other intensive computing, today announced the release of its second quarter results.

Michael Toporek, CEO of Soluna Holdings, Inc., said, “Despite the decline in the BTC price, our second quarter results represent significant year-over-year growth as the team continues to execute on our long-term plan. Soluna’s business was constructed with a focus on ultra-low energy cost assets, and that focus has enabled growth even in challenging times. We remain committed to investing through the current market cycle.”

Management’s presentation with the discussion of results including July flash financials will be released after the close on Wednesday, August 17th.

Key Summary Highlights:

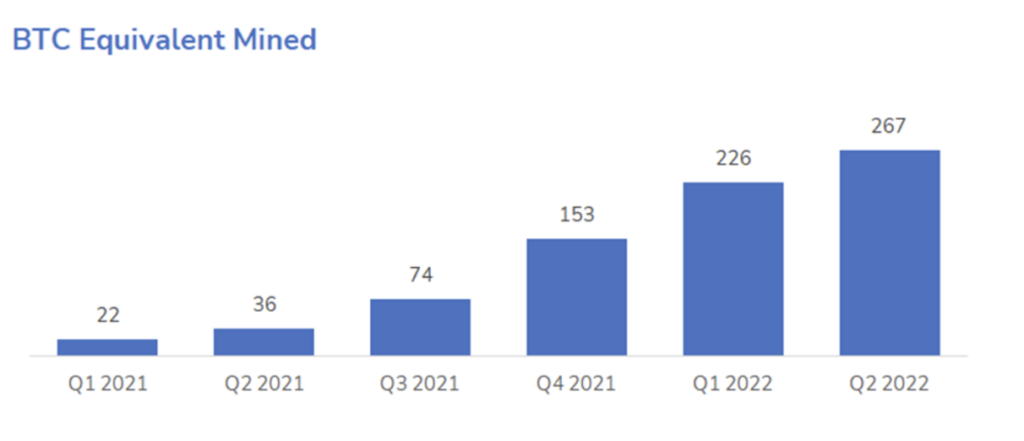

- BTC equivalent mined in the second quarter increased 7.5x year-over-year and 18.3% sequentially.

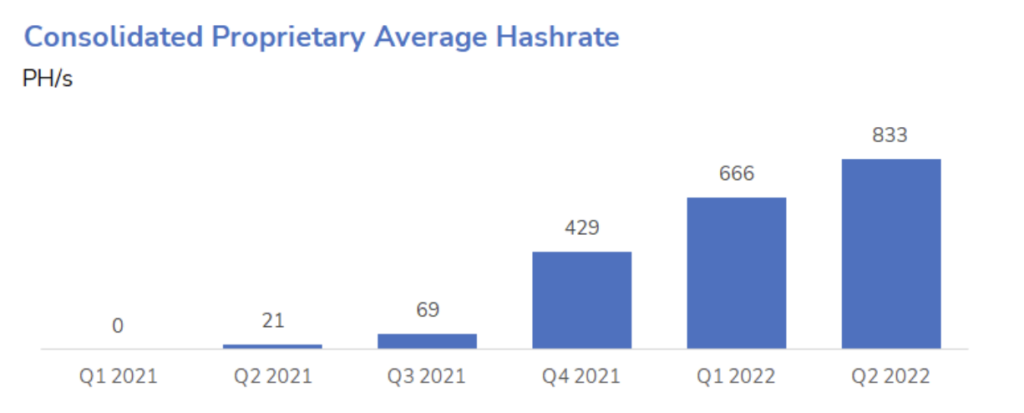

- Hashrate increased 38.8x year-over-year and 25.0% sequentially.

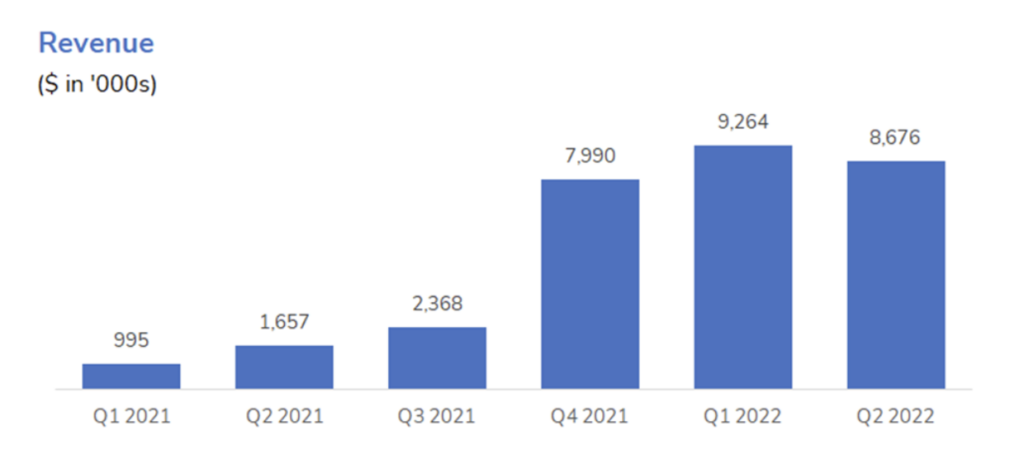

- Revenue for the six months ending June 30th, 2022 increased 6.8x over the prior year to $18.0 million.

- Revenue in the second quarter decreased only 6.3% from the prior quarter to $8.7 million despite a 21.3% decline in average BTC prices ($41k in Q1 down to $33k in Q2).

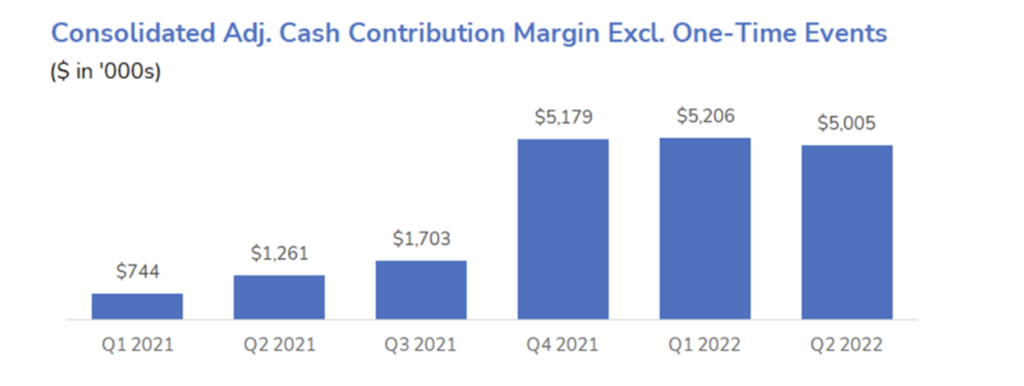

- Cash contribution margins excluding one-time events increased 4.0x year-over-year and only decreased 3.9% in the second quarter to $5.0 million despite BTC declines.

- Focus on monetizing low-cost, curtailed energy demonstrates resilience.

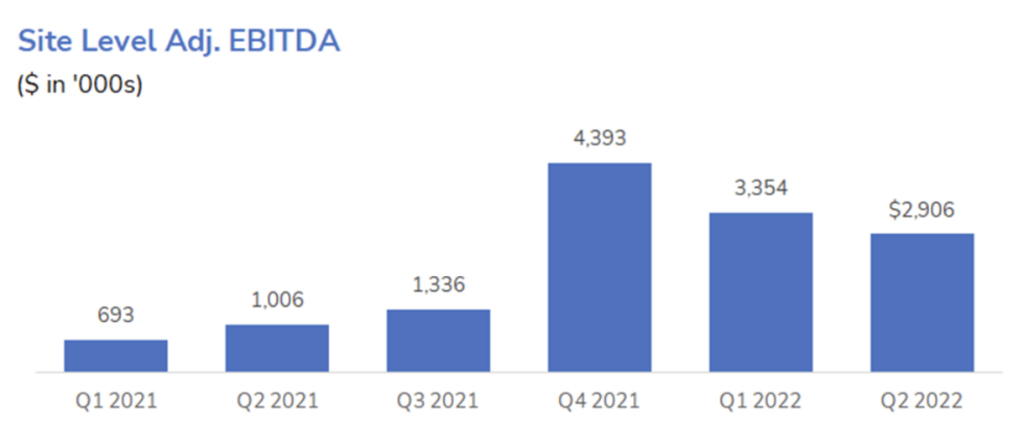

- Adjusted Site-level EBITDA for the three months ending June 30th, 2022 increased 2.9x to $2.9 million from $1.0 million in 2021.

- Adjusted Site-level EBITDA in the second quarter decreased 13.4% from the first quarter as a result of declining BTC prices and an increase in operating costs as the business scales to support its growing pipeline.

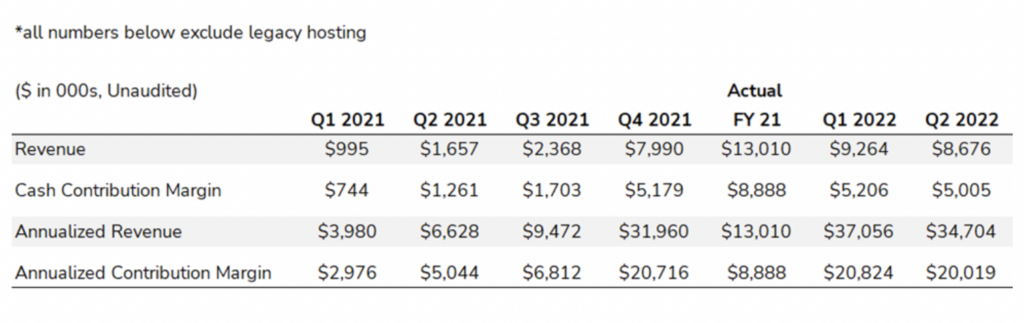

Revenue & Contribution Margin Summary:

Business Outlook:

The Soluna team continues to execute on its long-term vision to use batchable computing as a catalyst for renewable energy. In the second quarter, Soluna completed the ramp of project Sophie and continued development of the Dorothy project which we expect to begin energizing in early Q4. While the price of Bitcoin declined significantly over the quarter, we saw a marked increase in interest and commitment to computing as a solution to curtailed energy from renewable independent power producers (“IPPs”). Over the course of the second quarter, our long-term pipeline of opportunities grew to nearly 2GW, and we see multiple opportunities for our next 50-150 MWs of data center projects. As a result of the increasing adoption of our solution to curtailed energy, we believe now is the time to continue to invest to drive long-term investor returns. While markets may be volatile, we believe investing through the cycle is the best way to drive long-term investor results.

During the quarter, the volatility of bitcoin presented a significant challenge to our industry resulting in a 6.3% decline in dollar denominated revenue for our business. We built Soluna from inception with a strategic focus on energy costs, so while the decline in BTC price has a significant impact on our business we believe we are better positioned than many of our peers.

Our focus on sites with the ability to operate between $25-$27 per MWh means that when other miners are forced to unplug we are able to continue mining. As a result, despite the decline in BTC prices, we increased BTC equivalent mined by 18% in the second quarter, and we remain committed to investing through the cycle.

Discussion of Results:

- Continued growth in BTC equivalent mined despite BTC price declines demonstrates the resiliency of Soluna’s business model in volatile markets.

- BTC equivalent mined in the second quarter increased 7.5x year-over-year and 18.3% sequentially.

- Over the second quarter Soluna worked to optimize miner configurations and replace older machines with higher performance miners and take advantage of dislocations in the crypto mining equipment market.

- Hashrate continued to scale as Soluna continued the ramp up of Sophie.

- Hashrate increased 38.8x year-over-year and 25.0% sequentially.

- Peak hashrate well in excess of 1 EH / s.

- Rapid growth demonstrates Soluna’s ability to scale.

- Second quarter revenue increased 5.2x year-over-year.

- Revenue only decreased 6.3% sequentially despite average BTC prices over the quarter decreasing 21.3%.

- Increased curtailment and outages at Marie accounted for ~$0.6mm in the revenue lost in Q2.

- Largely seasonal, related to increased temperatures and resulting energy usage in summer months.

- Second quarter Adjusted Cash Contribution Margin excluding one-time events increased 4.0x year-over-year.

- Sequential decline of 3.9% despite 21.3% decline in BTC Price.

- 55.3% Prop mining contribution margins and 17.3% hosting margins excluding legacy hosting.*

- Sophie continues to perform exceptionally in a challenging BTC environment and remained at its 84% uptime for lower rate cards.

* Marie excludes pass-through revenue and expenses from Legacy Hosting customers. Electricity/Direct Costs reduced by Marie “Prepaid Lease Cost” August 2021 onward. For details on legacy hosting, see appendix.

- Second quarter Site Level Adjusted EBITDA increased 2.9x year-over-year

- Sequential decline of 13.4% despite 21.3% decline in BTC Price

- Increased overhead and SG&A costs to support long-term pipeline growth which reached nearly 2GW in the quarter

About Soluna Holdings, Inc.

Soluna Holdings, Inc. (Nasdaq: SLNH) is the leading developer of green data centers that convert excess renewable energy into global computing resources. Soluna builds modular, scalable data centers for computing-intensive, batchable applications such as cryptocurrency mining, AI and machine learning. Soluna provides a cost-effective alternative to battery storage or transmission lines. Soluna uses technology and intentional design to solve complex, real-world challenges. Up to 30% of the power of renewable energy projects can go to waste. Soluna’s data centers enable clean electricity asset owners to ‘Sell. Every. Megawatt.’

For more information about Soluna, please visit www.solunacomputing.com or follow us on LinkedIn at linkedin.com/solunaholdings and Twitter @SolunaHoldings.

Forward Looking Statements

The statements in this press release with respect to the progress of Soluna’s development pipeline and the ability to scale the Dorothy project to assist partner organizations constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements reflect management’s current expectations, as of the date of this press release, and are subject to certain risks and uncertainties that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Actual results could differ materially from those expressed or implied by such forward-looking statements as a result of various factors, including, but not limited to: (1) those risk factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and other reports filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. Except as required by law, the Company assumes no obligation to update or revise any forward-looking statements.

Contact Information:

Chris Gandolfo

Financial Reporting Manager

Soluna Holdings

christopher@soluna.io

518 218 2565

Investor Relations

Brian M. Prenoveau, CFA

MZ Group – MZ North America

SLNH@mzgroup.us

561 489 5315

Non-gaap Reconciliations: